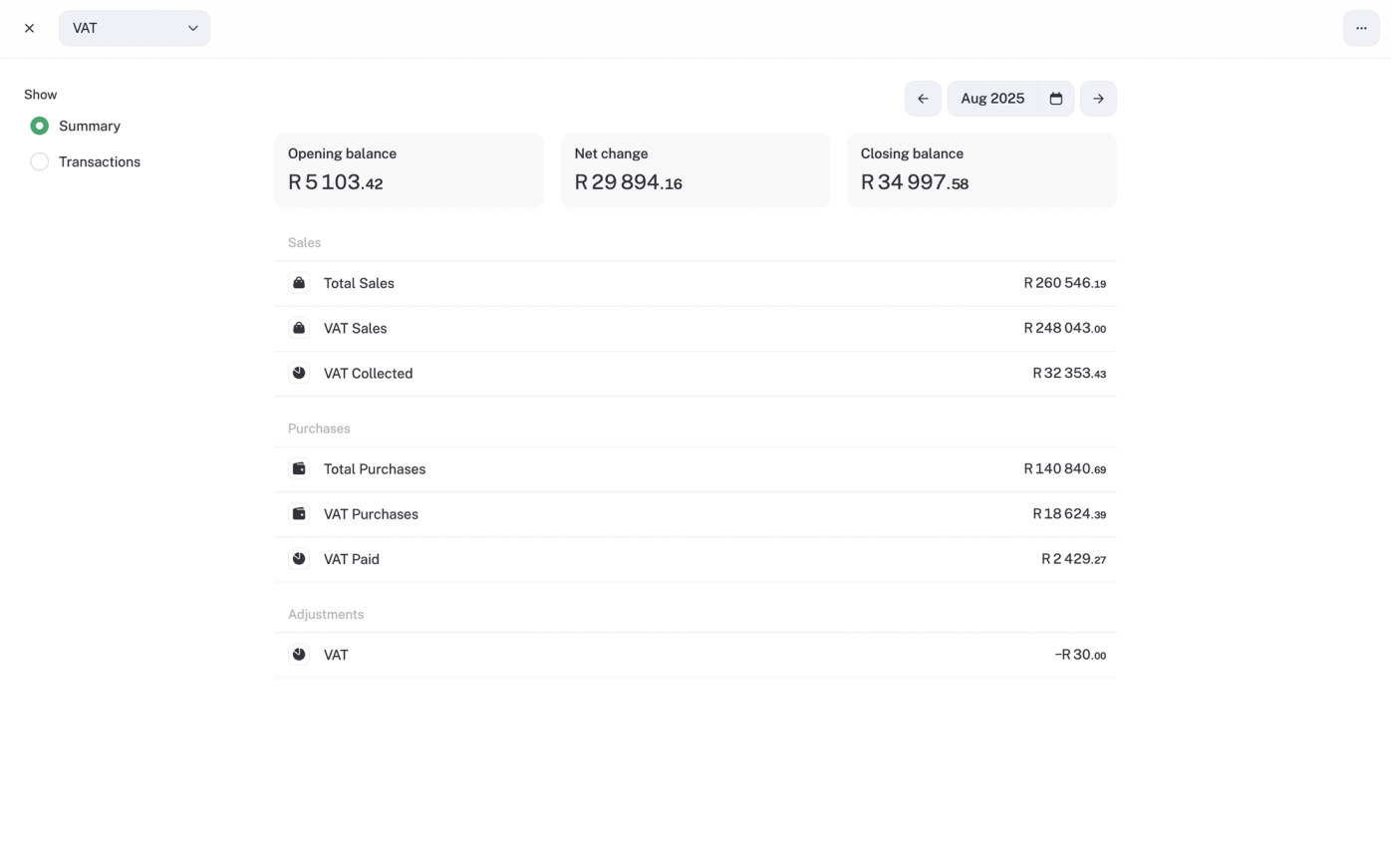

VAT / Sales Tax report

See how much tax you’ve collected, paid, and owe — all in one place.

If you’re registered for VAT (or another type of sales tax), this report keeps all your totals in one place. No spreadsheets or calculator gymnastics required.

It shows how much VAT you’ve collected from customers, how much you’ve paid to suppliers, and the net amount you’ll need to submit (or claim back) when your return is due.

VAT you've collected: tax on your sales

The VAT you’ve added to invoices for customers.

Example: The salon invoices R1,000 for a treatment. With VAT at 15%, the customer pays R1,150. The extra R150 is VAT collected, money the salon must pass on to SARS.

VAT you've paid: tax on your purchases

The VAT included in your business expenses.

Example: The salon buys stock worth R5,750 (including VAT). Of that, R750 is VAT paid, which the salon can later claim back.

Net VAT: what you owe (or can claim back)

The difference between VAT collected and VAT paid, usually what’s due to SARS, or what you’ll be refunded.

Example: If the salon collected R5,000 VAT from customers this month and paid R3,000 VAT on stock, the net VAT is R2,000 payable to SARS.

You can breakdown by category, supplier, or customer

See where VAT is being collected and paid across different parts of your business.

For example, the salon could compare VAT on treatments versus VAT on retail product sales.

Where the numbers come from

- VAT enabled in your Business Settings

- VAT added to invoices

- VAT recorded on expenses

- VAT codes applied to imported or categorised transactions

Payable vs claimable VAT

- Payable VAT: VAT you’ve charged customers and need to pay over.

- Claimable VAT: VAT you’ve paid on business purchases that you can claim back.

💡Tips

- Make sure VAT is set up correctly in Business Settings before creating invoices or expenses.

- Double-check that expenses with VAT have the right tax rate selected.

- Use Tags (Pro) to track VAT activity by location, department, or event.