Profit & Loss Report

Track what you’ve earned, what you’ve spent, and what’s left over.

The Profit & Loss (P&L) report, also called an Income Statement is your business’s scoreboard. It shows if you’re winning (making a profit) or losing (making a loss) over a set period. It matches income earned against expenses incurred, even if the money hasn’t yet moved in or out of your bank account.

Here’s the trick: it works on accrual accounting, which is less “what’s in your wallet right now” and more “what’s on your money to-do list.” If you’ve done the work and sent an invoice, that’s income, even if the client hasn’t paid yet. If you’ve received an invoice for rent, that’s an expense, even if you haven’t paid it yet. This way, the P&L gives you a clearer picture of how your business is really performing, not just how much cash happens to be sitting in your account today.

TL;DR

- Income includes both paid and unpaid invoices.

- Expenses include invoices you’ve recorded, even if you haven’t paid them yet.

The result is a clearer view of how your business is really performing.

Example: A salon invoices R10,000 in May. Even if the client only pays in June, May’s P&L still shows R10,000 in income.

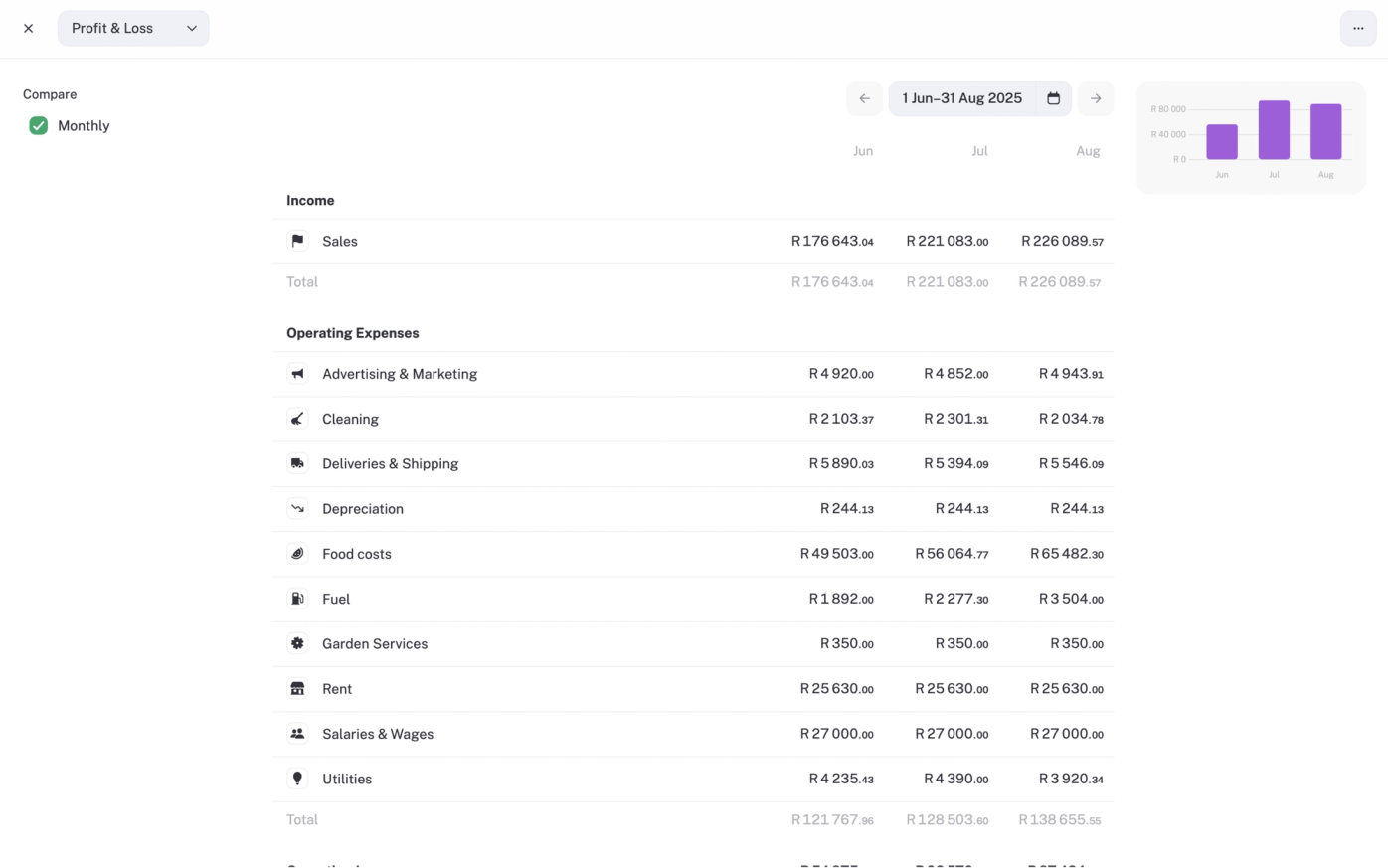

The numbers that makeup your P&L

Income (Revenue): sales you’ve earned

All sales and service income earned in the period, whether paid or not.

Example: The salon records R15,000 in treatment income and R5,000 in product sales for May, totalling R20,000 income.

COGS (Cost of Goods Sold): direct costs of sales

The costs tied to producing or delivering what you sold, also known as Cost of Sales (different name, same thing.

Example: The salon spent R4,000 on shampoo and treatments sold to clients.

Operating expenses: the cost of keeping the doors open

The day-to-day costs of running the business (rent, salaries, software, subscriptions).

Example: The salon pays R10,000 in rent, R3,000 in staff wages, and R500 for booking software.

Other income/expenses: one offs and extras

Items not tied to core operations, e.g. a once-off grant, forex gain/loss, or bank charges.

Example: The salon pays R250 in bank fees and receives a once-off R5,000 business grant.

Profit (or loss): what’s left over

Income minus expenses = the bottom line.

Example: R20,000 income – R4,000 COGS – R13,500 expenses = R2,500 profit.

P.S. This is profit before tax. stub shows your business profit but doesn’t include company tax calculations in the P&L.

Where stub gets the info

- Invoices & income: Both paid and unpaid invoices you’ve logged. (If it’s in stub, it shows up here.)

- Expenses: Anything you’ve added manually or that’s been pulled in from your bank feed.

- Adjustments: Extra stuff from connected accounts, think loans, VAT, or other bits that tweak the numbers.

P.S. No quotes: Half-baked transactions don’t make the cut. Only finalised numbers hit your P&L.

Filters and tags

- Adjust the date range (month, quarter, year, or custom period).

- Use Tags (Pro) to break results down by project, campaign, or channel. Example: Tag transactions by marketing campaign to see if it paid for itself, or by region to compare performance across branches.

Why does the P&L report matter?

- Spot whether revenue is growing faster than expenses.

- See how much your COGS eats into sales.

- Compare operating expenses over time to flag overspending.

- Understand the true profitability of your business beyond just cash in the bank.

💡Tip:

If your P&L looks healthy but your bank balance doesn’t, check your Cash Flow report. Customers might be slow to pay, or you could have big upcoming bills.