General Ledger

Where all your numbers come together

Your general ledger is the backbone of your accounting system. It’s the master record of everything your business earns, spends, owns, and owes. Every transaction eventually lands here, sorted into the right accounts so your reports stay accurate.

Think of it as your financial “source of truth.”

What is a general ledger?

A general ledger is a complete record of your business’s financial activity. It keeps track of how money moves in and out of your accounts: income, expenses, assets, liabilities, and equity.

Behind the scenes, stub uses double-entry accounting. This means every transaction affects at least two accounts. You don’t have to post both sides yourself, because stub takes care of that automatically.

For example:

- You pay for office rent → stub records it as Rent Expense (debit) and Bank Account (credit).

- You receive payment from a customer → stub records it as Bank Account (debit) and Sales Income (credit). (If you didn’t raise an invoice in stub, it would instead record Bank Account (debit) and Sales Income (credit).)

Why your general ledger matters

Your general ledger powers your Profit & Loss, Balance Sheet, and Trial Balance reports.

It helps you:

- Keep every transaction in one place. Think of it as your money diary: recording sales, rent, stationery, and every other financial move your business makes.

- Catch mistakes early. When everything is logged correctly, you can trace your numbers and see if something doesn’t add up; like a detective for your finances.

- Understand your business story. Your ledger shows whether you’re growing, struggling, or spending too much on coffee.

Without it, your reports would be incomplete.

What makes up your general ledger

Your ledger is built from your Chart of Accounts, which is grouped into five main categories:

- Assets: what your business owns (cash, equipment, inventory)

- Liabilities: what your business owes (loans, supplier payments, VAT payable)

- Equity: the value of the business that belongs to you or other owners

- Income: what your business earns from sales

- Expenses: what your business spends to operate

Every transaction in stub updates one or more of these accounts automatically.

How it works in stub

stub continuously updates your general ledger as you work.

Entries flow in from:

- Invoices and customer payments

- Expenses and supplier bills

- Bank feeds and CSV imports

- Asset purchases and depreciation

- Manual journal entries

You can view your ledger by going to More → General Ledger in your left-hand menu.

Filter by category or account to see exactly where your money is coming from or going to.

What you’ll see

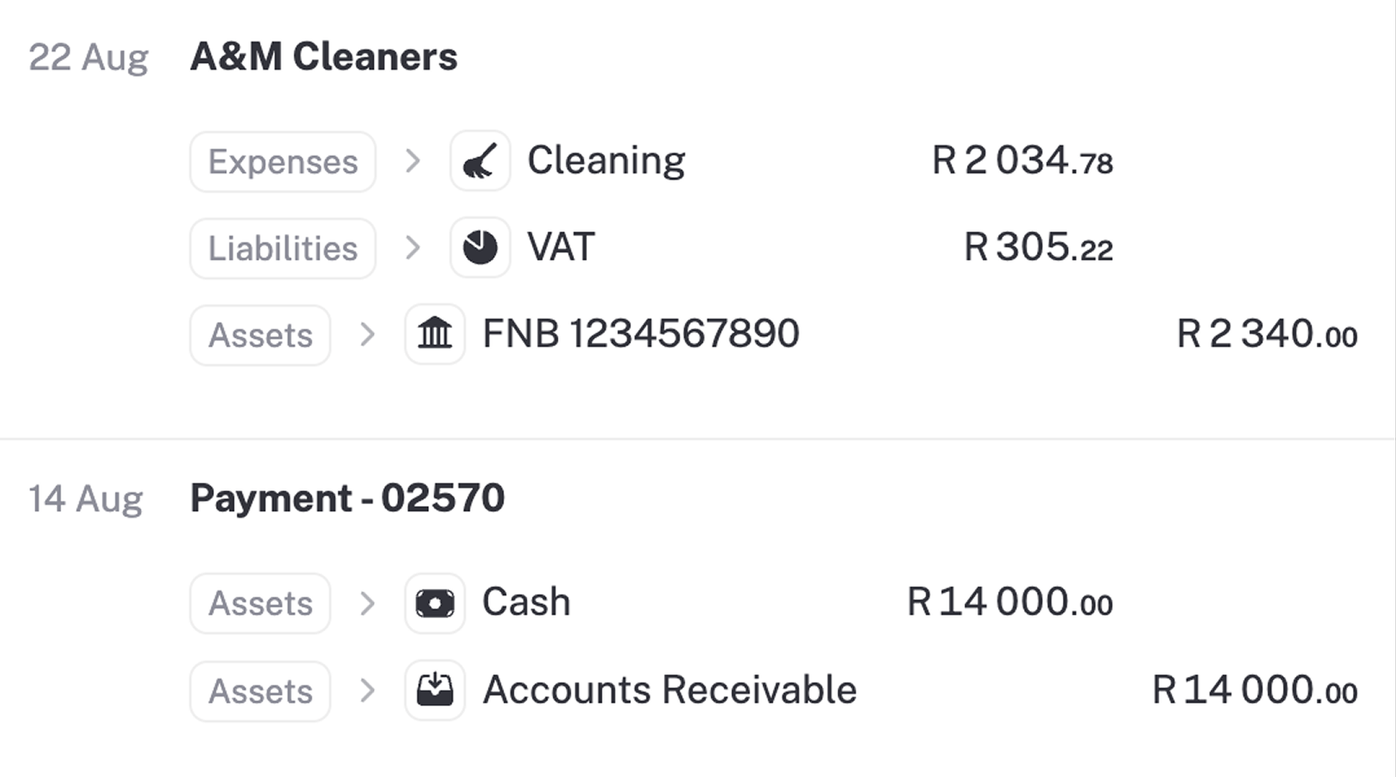

Each line shows:

- The date of the transaction

- The accounts affected (for example, Bank Charges and Capitec Bank)

- The category (Expense, Asset, or Income)

- The debit and credit amounts

stub keeps these entries balanced automatically.

Example: how it works in practice

Let’s say you buy a new laptop for R12,000 using your business bank account.

stub will:

- Debit your Computers & Devices (Asset) account for R12,000

- Credit your Bank Account (Asset) for R12,000

You don’t have to enter both sides. stub handles that for you and updates your reports instantly.

Good to know

If something looks off in your ledger, check the original transaction instead of editing it directly.

stub automatically updates your ledger whenever you make changes elsewhere, so it always stays balanced.