Chart of Accounts

Your business’s financial filing cabinet

Your Chart of Accounts is how stub organises your money into categories. Every transaction needs a home, and these accounts are where it lands.

Think of it as the master list of buckets for your income, expenses, assets, liabilities, and equity.

What is a Chart of Accounts?

A Chart of Accounts, or COA, is the structured list of every account in your books. It groups transactions so your reports make sense and your books stay balanced.

Each account has:

- A name such as Sales or Bank Charges

- A type such as Asset, Liability, Equity, Income, or Expense

- A balance that updates as you record transactions

Your Profit & Loss and Balance Sheet are built from these accounts.

The five account types

- Assets: what your business owns, for example bank accounts, equipment, inventory

- Liabilities: what your business owes, for example loans, supplier balances, VAT

- Equity: what’s left for the owner(s) after subtracting what the business owes from what it owns. It reflects the net value of the business.

- Income: money you earn from sales or services

- Expenses: money you spend to run the business

Where to view your Chart of Accounts

You can view your accounts from the ledger.

- Go to More → General Ledger.

- Click Filter → Category to see the five types, or Filter → Journal to browse a specific account.

- You will see accounts like Sales, Bank Charges, Computers & Devices, VAT, Retained Earnings and more, each with a short description.

This view is perfect for checking what accounts exist and how entries post to them.

Where to edit or add accounts

You can only change the Chart of Accounts in Business settings.

- Go to More → Business.

- Under Accounting, select Chart of Accounts.

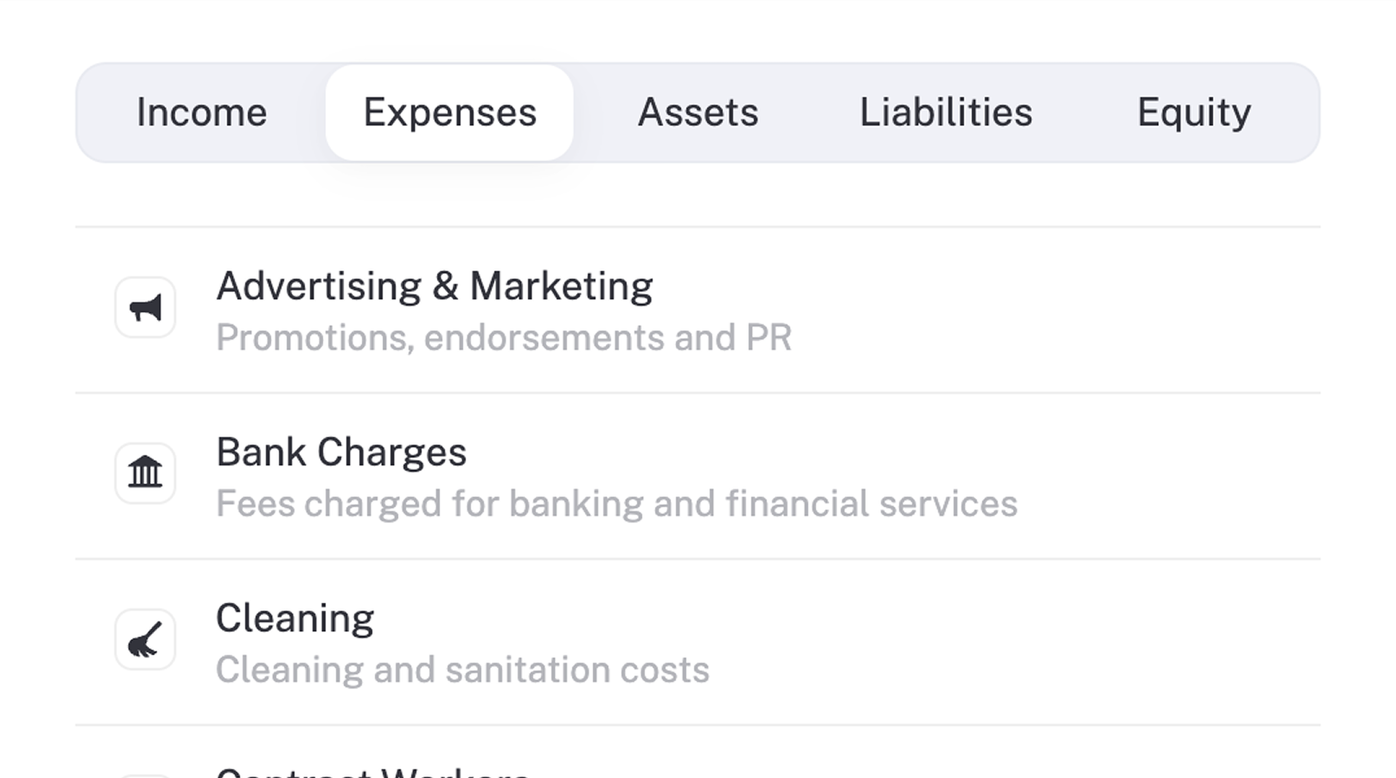

- Use the Income, Expenses, Assets, Liabilities, Equity tabs to find the right place.

- Click Add account to create a new one, or open an account to rename or update its description.

- Save your changes.

Example: add a new income account

You run workshops and want to track that income separately from general Sales.

- More → Business → Chart of Accounts.

- Open the Income tab.

- Click Add account, choose Income, name it Workshop Fees, add a short description, then Save.

Next time you record workshop revenue, choose Workshop Fees and it will show as its own line in your Profit & Loss.

The significance of a Chart of Accounts?

A tidy Chart of Accounts gives you clearer reports, easier tax prep, and fewer mistakes when categorising transactions.

Keep it simple and add only the accounts you truly need.

Good to know

- You cannot delete accounts that already have transactions. Archive them instead.

- stub adds key accounts automatically, for example Retained Earnings and VAT.

- Viewing happens in General Ledger. Editing and adding happens in Business settings.