How to create invoices

You’ve done the work, or you’re about to. Either way, you won’t see the money until you send the invoice. It’s how you make things official: what’s owed, when it’s due, and what it’s for.

In stub, creating an invoice is quick, keeps your books tidy, and helps your cash flow stay healthy.

What an invoice really is

The textbook version

A dated document that records a sale between you (the seller) and your customer (the buyer). It adds income to your accounts and creates a “receivable” – fancy speak for money that’s still owed.

In plain English:

It’s your contract. It shows what the customer owes, what they’re getting, and when payment is due.

Why this matters: An invoice isn’t just paperwork. It’s your proof of sale, your legal protection if a client doesn’t pay, and the record that keeps your books accurate.

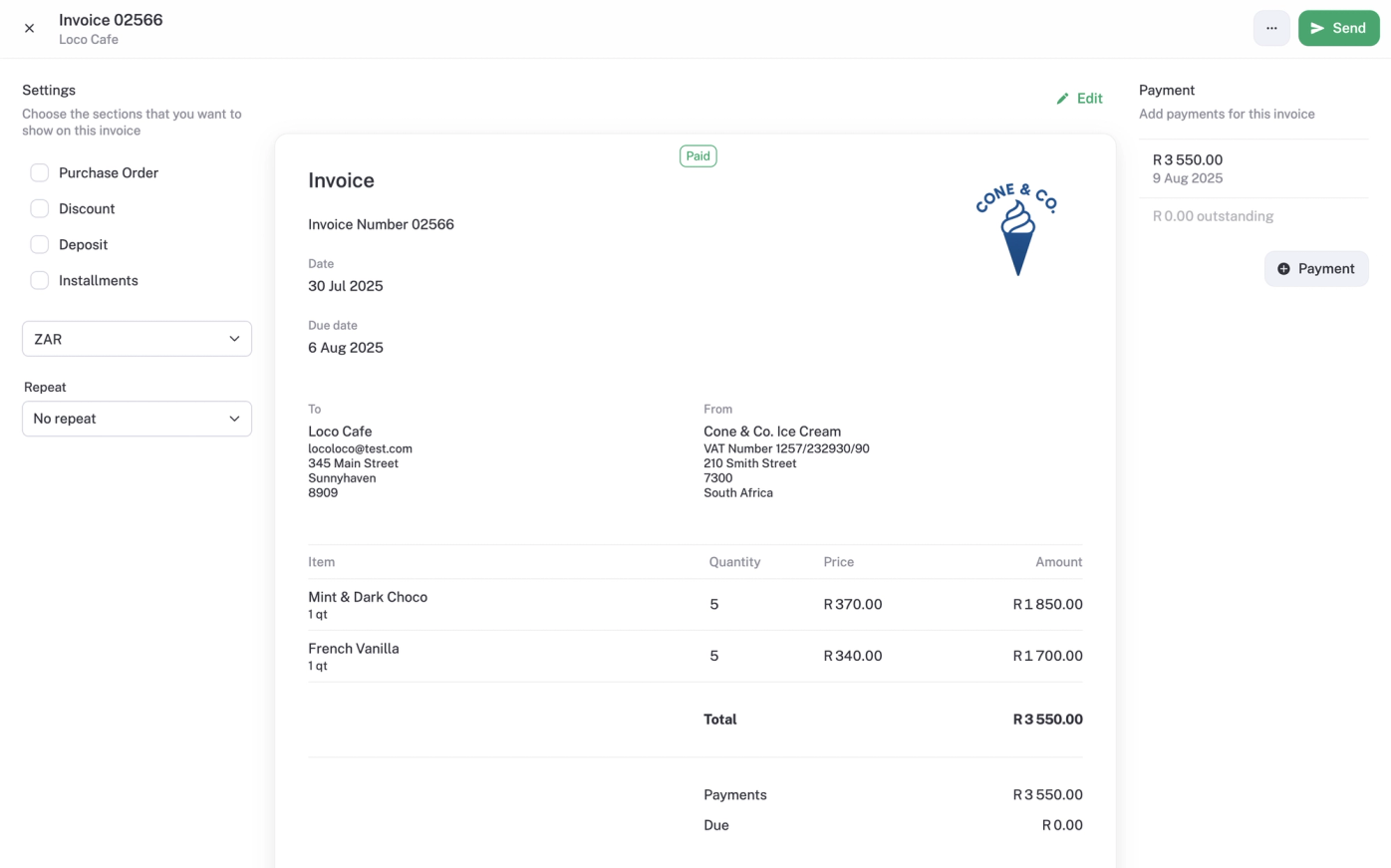

How to create an invoice in stub

- Start the invoice:

- From the left menu, go to Sales → + Invoice.

2. Fill in the basics:

- From + To: add your business details (name, email, physical address) and your customer’s details (name, email, physical address).

- Invoice number (auto-generated, sequential, no duplicates, you can edit if needed)

- Invoice date and due date (When the customer should pay you by)

- Customer (select or add new)

- Currency (Pro supports multi-currency)

- Repeat (if it’s a recurring invoice or retainer client)

💡 Note: If you’re VAT-registered, your invoice must say “Tax Invoice” and include your VAT registration number, VAT rate, and VAT amount (either p

4. Optional extras

- Purchase Order (PO) number. Some customers will give you one; it helps them match your invoice to their internal records.

- Discounts (total only for now). A fixed amount or percentage off the full invoice total.

- Deposit (for partial upfront payment)

5. Add notes

- Description (top): context, e.g. “March 2025 salon services.”

- Notes (bottom): payment instructions, e.g. “Payment due within 7 days via EFT.”

Example: Notes: “Thanks for your visit! Please pay within 7 days. Card and EFT accepted.”

💡 Tip: Want all your invoices to look consistent? Set your default title, notes, and other details under Business settings, stub will apply them automatically every time. But you can change these per invoice.

6. Bank details

- Add your bank details here, if you haven't already in Business Settings. And always double-check, one wrong digit and your money takes the scenic route. Update in Business Settings → Bank accounts if needed.

7. Send

- Click Preview to see what your customer will get, then hit Send.

The must-haves on an invoice

- The word “Invoice” (or “Tax Invoice” if VAT-registered)

- A unique invoice number (sequential, no duplicates)

- Your business details (name, address, contact, logo)

- Customer details (name, address/email, contact)

- Invoice date and payment due date

- List of products/services (titles, descriptions, prices, quantities)

- Total amount due

- Your bank details

- If VAT-registered: your VAT registration number, the VAT rate, and VAT amount (per line or total)

Why invoices are more than just admin

They meet the rules

In South Africa, invoices must have the right details (numbers, dates, business info). If you’re VAT-registered, it must also say “Tax Invoice” and show your VAT registration number.

They help you stay organised

Every invoice adds income and shows you what cash is still on the way.

It’s a way of protecting yourself

If a client doesn’t pay, the invoice is your legal proof.

They look professional

A neat, branded invoice tells customers you’re running a real business, not scribbling on scraps.

Example: An invoice for a bridal package spells out what’s included and when payment is due, so there’s no confusion about payment.

FAQs

How long should I give for payment?

It’s up to you and your cashflow: immediate, 7 days, 30 days, 60 days. You can always try to negotiate, but most corporates play by their own (pretty rigid) timelines.

Can I edit and resend an invoice?

But never delete an invoice. If you need to correct one that’s already been sent, issue a credit note or create a new invoice. Every invoice number must stay in your records for compliance.

Tips for better invoicing

- Add your logo so customers spot it instantly.

- Keep notes polite but clear.

- Send invoices quickly; the sooner you send, the sooner you’re paid.

- Double-check bank details. Typos = delays.

Invoices aren’t just admin. They’re your sales record, your safety net if payments go sideways, and your ticket to cash in the bank. With stub, they’re quick to create, and essential to keeping your business running smoothly.