How to add depreciation

Pro

Depreciation spreads the cost of an asset over the time you use it. It’s how your books reflect wear and tear and how your reports stay realistic.

When you add depreciation in stub, the system calculates it for you every month until the asset’s useful life ends or it’s marked as disposed.

Why depreciation matters

- It keeps your reports accurate by reducing the asset’s value each month.

- It spreads big costs over time instead of showing one large expense in the month you bought it.

- It’s tax-friendly because depreciation counts as a deductible business expense.

How depreciation works in stub

You can choose between:

- Straight line: Spreads the cost evenly over time.

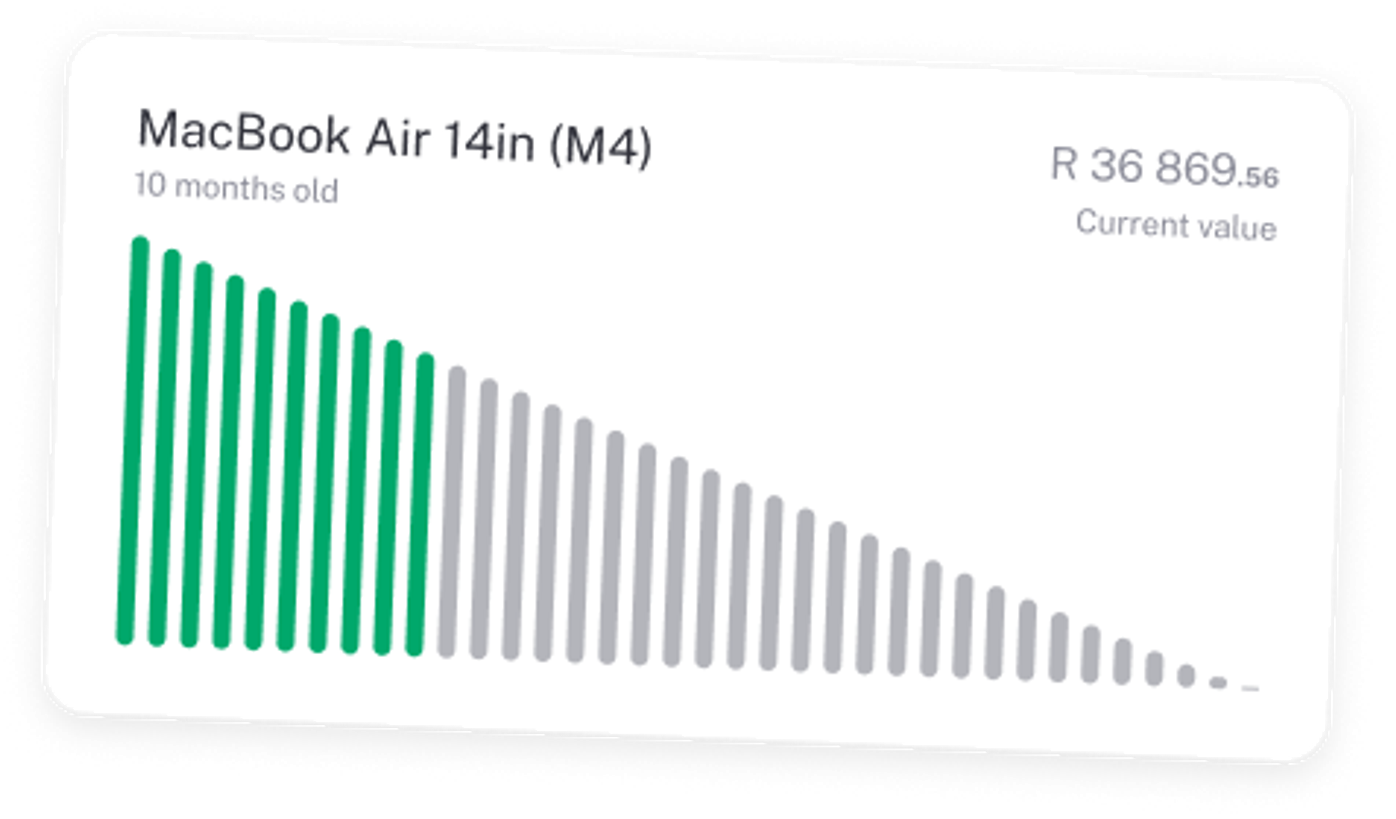

- Diminishing value: Higher depreciation at first, smaller amounts later. This works better for assets that lose value quickly, like cars or tech.

Examples

Straight line depreciation

- A photographer buys a camera for R24,000 and expects to use it for 3 years.

- stub records R667 each month for 36 months.

- A bakery buys an oven for R60,000 with a useful life of 5 years.

- stub records R1,000 each month for 60 months.

Diminishing value depreciation

- A delivery company buys a bakkie for R240,000. Vehicles lose value faster early on, so the first year’s depreciation is higher, and it decreases over time.

- A software company buys laptops for R18,000 each. Computers become outdated quickly, so this method makes sense to show the drop in value earlier.

To edit depreciation

- Go to Assets.

- Open the asset you want to change.

- Adjust the depreciation method, start date, or useful life.

- stub will update the remaining depreciation automatically.

TIP: Straight line is great for items that wear out steadily, like furniture or fridges. Diminishing value is better for things that lose value quickly, like vehicles and electronics.