Cash Flow report

Your real-world view of money movement – what’s actually in the bank.

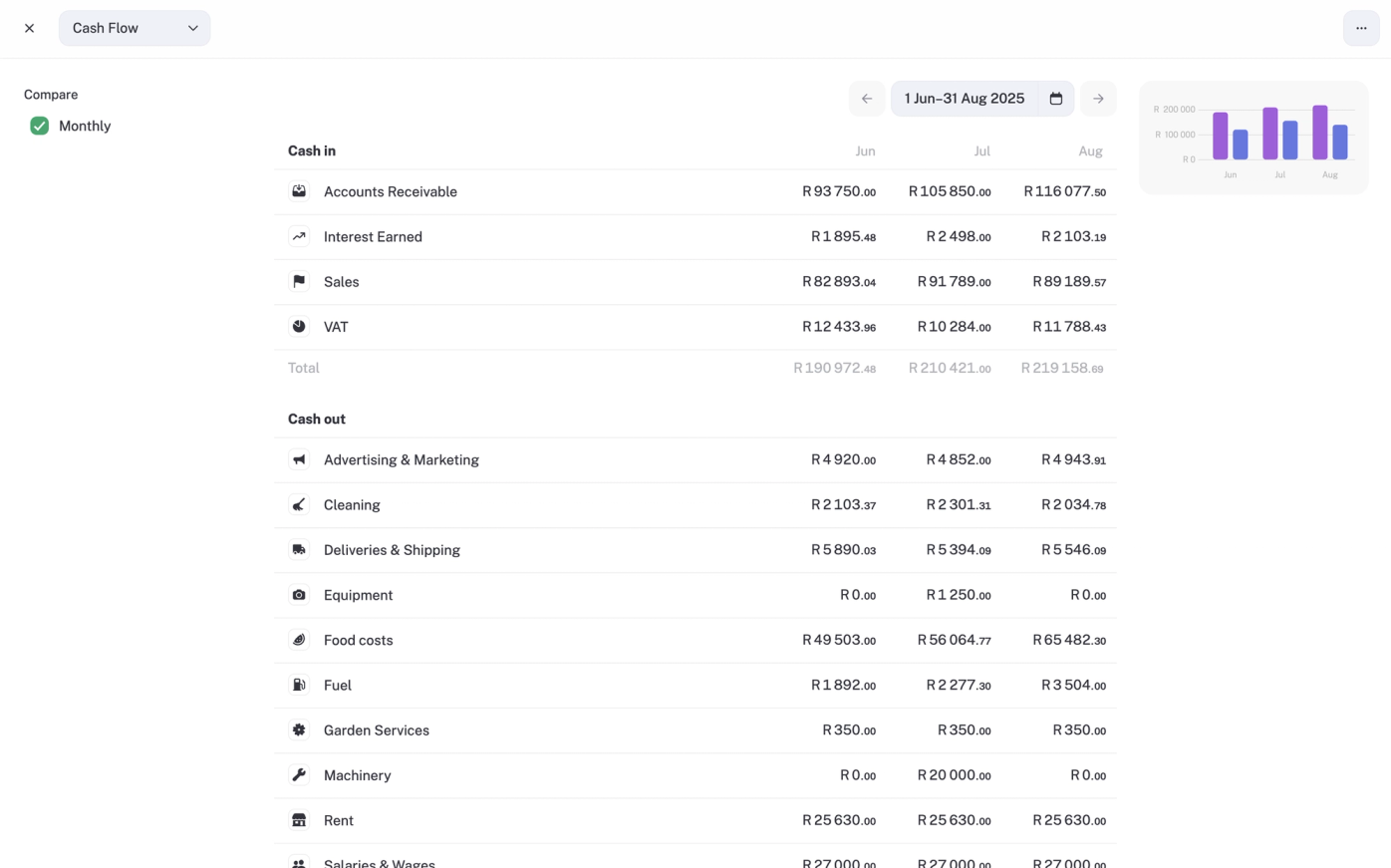

Think your business is doing great on paper but still feel broke? That’s where the cash flow report comes in. While the P&L tells you if your business is profitable on paper, cash flow answers the question: can I pay the bills today?

The story your cash flow tells

Cash in: money that arrived

Money that actually arrived in your account (like paid invoices or refunds).

Example: The salon collected R15,000 in client payments this month, plus R2,000 from retail sales.

Cash out: money that left

Payments made for rent, salaries, suppliers, and more.

Example: The salon paid R10,000 rent, R5,000 for stock, and R3,000 in staff wages.

Net cash flow: the difference

Cash in minus cash out. Positive = more in than out. Negative = spending more than you’re earning.

Opening and closing balances: your bank bookends

Shows how much cash you started and ended with in the chosen period.

Where do these numbers come from?

- Paid invoices and income entries.

- Paid expenses (manual or from your bank feed).

- Supplier payments.

- Bank transfers in and out.

Why your Cash Flow doesn’t match your P&L

Cash flow is based on actual cash movement, money hitting or leaving your account. Your Profit & Loss, on the other hand, works on accruals: when income and expenses are recorded, even if the money hasn’t moved yet.

Example: The salon invoices a bridal party R10,000 in May. The P&L shows May income of R10,000, but the Cash Flow report only shows it in June, when payment arrives.

This timing gap explains why you can look profitable but still be short on cash.

How to slice and share your cash flow

- Change the date range to spot short-term dips or long-term trends.

- Use Tags (Pro) to see cash flow for a specific client, project, or product line.

- Export as CSV or PDF if you need to share with an accountant or investor.

Pro tips & red flags to watch for

If your P&L looks great but cash flow doesn’t, check overdue invoices.

👉 Example: The salon shows R50,000 in sales for May, but R30,000 is still unpaid, leaving little cash in the bank.

Not seeing expected numbers? Double-check transaction dates.

👉 Example: You pay rent on 30 June, but the debit only clears on 1 July. That spend belongs to July’s cash flow, not June’s.

Use it before making big decisions.

👉 Example: The salon wants to buy new chairs for R20,000. P&L looks healthy, but cash flow shows only R8,000 available today.

Remember the lag.

👉 Example: Weekend product sales through PayFast only hit the bank mid-week.

Bottom line: The cash flow report is your “can I pay for this today?” reality check. P&L shows profitability. Cash flow shows liquidity.