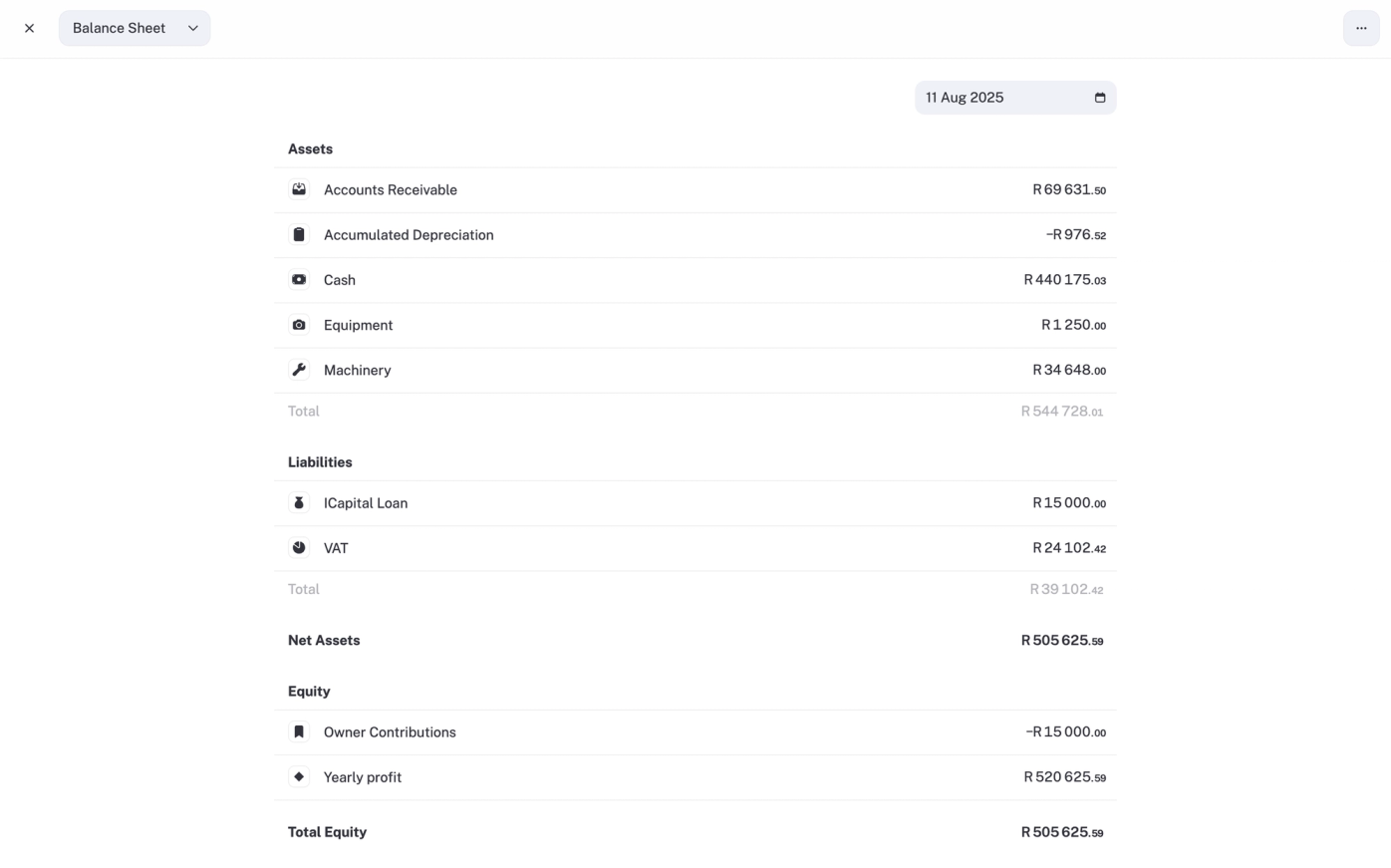

Balance Sheet report

See what you own, what you owe, and what’s really yours.

The Balance Sheet is your business’s financial selfie. It shows what you own, what you owe, and what’s left (your equity) at a specific point in time. Accountants rely on it to judge financial position. For everyone else, it is the “what am I really worth right now?” check-in.

Example: At the end of June, the salon looks at its Balance Sheet to see if its stock, chairs, and cash outweigh the loan it still owes.

The three pillars of a Balance Sheet

Assets: the stuff you own that has value

Everything the business controls that can bring future benefit.

- Tangible assets are physical things you can use or sell, such as equipment, vehicles, or stock.

- Intangible assets are less visible but still real, like cash in the bank or money owed by customers.

Example: The salon holds R30,000 in stock, R50,000 in equipment, and R20,000 in the bank. Total assets = R100,000.

Liabilities: the stuff you owe

Debts and obligations the business must settle. Things like loans, unpaid supplier bills, VAT owed, or credit card balances.

Example: The salon owes R15,000 to a supplier and R50,000 on its loan. Liabilities = R65,000.

Equity: what is really yours

Equity is assets minus liabilities. It is the business’s net worth and represents what would be left for the owner if everything was sold and debts were paid.

Example: R100,000 assets minus R65,000 liabilities = R35,000 equity. That is the salon’s “real” worth on paper.

Where stub gets the numbers

- Invoices and income you’ve logged (these roll into “current year earnings” under equity)

- Expenses you’ve added manually or from your bank feed

- Connected bank accounts

- Assets you’ve added

- Loans or liabilities you’ve set up

- Any opening balances entered

The Balance Sheet updates automatically as you go (as do all reports!). No end-of-month button-pushing required unless you are making adjustments.

When to use your Balance Sheet report

Check financial health

Do your assets outweigh your liabilities?

Apply for funding or credit

Banks and investors often ask for a Balance Sheet before approving finance.

Plan for growth

Compare Balance Sheets over time to see whether your net worth is increasing.

In short: Assets show what you own. Liabilities show what you owe. Equity shows what is really yours.